- Subscribe to RSS Feed

- Mark Thread as New

- Mark Thread as Read

- Float this Thread for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

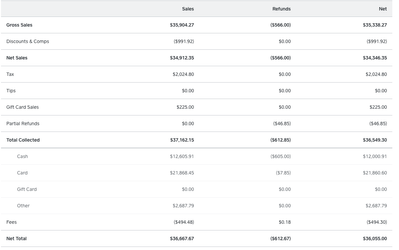

My Monthly Report shows only "Net Sales", not Gross Sales and the appropriate deductions to come up with the Net sales. So where is my collected sales tax shown? Is it included in the Net Sales or has it been excluded? To me, Gross Sales should include everything and Net Sales should exclude sales tax collected and Square fees. My daughter says the Net number on Square's Report includes sales taxes, so when we file to pay sales tax each month, she takes that Net number from the Square Report, deducts the sales tax to get the "real" Net number, and that's the number she reports to the county as Net Sales to which we add and collect sales tax. Please educate us. Many thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

If you look at this report https://squareup.com/dashboard/sales/reports/sales-summary and choose a month it will show you everything you need to know (Gross, net, sales tax, refunds etc). The Gross is what you sold, the net is sold minus discounts. The tax is not included in those figures, it is listed separately but is totaled in the "total collected"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

If you look at this report https://squareup.com/dashboard/sales/reports/sales-summary and choose a month it will show you everything you need to know (Gross, net, sales tax, refunds etc). The Gross is what you sold, the net is sold minus discounts. The tax is not included in those figures, it is listed separately but is totaled in the "total collected"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

So are the taxes collected on the gross sales or the net sales?

For example

Taxes are collected against Gross Sales, then

Gross sales=$100.00 and taxes are 10%, Discounts = $50.00, Net sales = $50, but taxes collected = $10 or 10% of Gross Sales

or taxes are collected against Net Sales, then

Gross sales=$100.00 and taxes are 10%, Discounts = $50.00, Net sales = $50, taxes collected = $5 or 10% of Net Sales

Which on is it?

If taxes are collected on Net Sales and I have to report taxes collected based off Gross Sales, then I am having to come out of pocket for sales taxes not collected. How do I change the way taxes are collected?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Hello @gcoughlin.

The tax you collect will be displayed in a separate section. If you Click on @VanKalkerFarms image you can see an example of how it's displayed. Your Sales Tax will be included in the Total collected value under gross.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

I am attempting to pay my CA Sales Tax (due today!) but as I am trying to get the amount I collected last year, it isn't all calculating. I have never encountered this problem.

Thank you for any help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

This might be a super lame question - but have you checked which fields the reports are showing? Mine sometimes default to not showing the fields I particularly want to use on a regular basis. I can't recall if sales tax is one of the ones that it doesn't default to or not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Hello @lilgreenwagon! I've just moved your post here so you can see how to view the sales tax you collected from your Square Dashboard.

Your sales tax will appear under 'tax', and as @jjgard mentions, it's a good idea to check the date selected, and if you've selected any filters for Advanced reporting!

If you still have any questions please let me know or give our Support team a call if you need help ASAP!

Seller Community Manager

Did you find help in the Seller Community? Mark a Best Answer to help others.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Thank you! I found out the sales tax I collect through my website (linked to Square) does not calculate together. Bummer! It did last year. Why the change?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

I'm also confused on which retail sale number to use to report my sales taxes. There are 3 given. Gross sales, net sales and taxable sales. Which one would i use to report sales and usage tax??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

I noticed when I pull sales reports, I noticed that some items have the Gross Sales listed as the item price minus sales tax and other items show the Gross Sales number listed just the item price with no sales tax attached.

How do I make that stop? I'd like to see the Gross sales number without the sales tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report

Hey @209GeneralStore,

I moved your post to an existing thread where another seller broke down how the reporting works and what it includes for visibility.

Check out @VanKalkerFarms post above.

Community Moderator, Square

Sign in and click Mark as Best Answer if my reply answers your question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report